Tokenomics

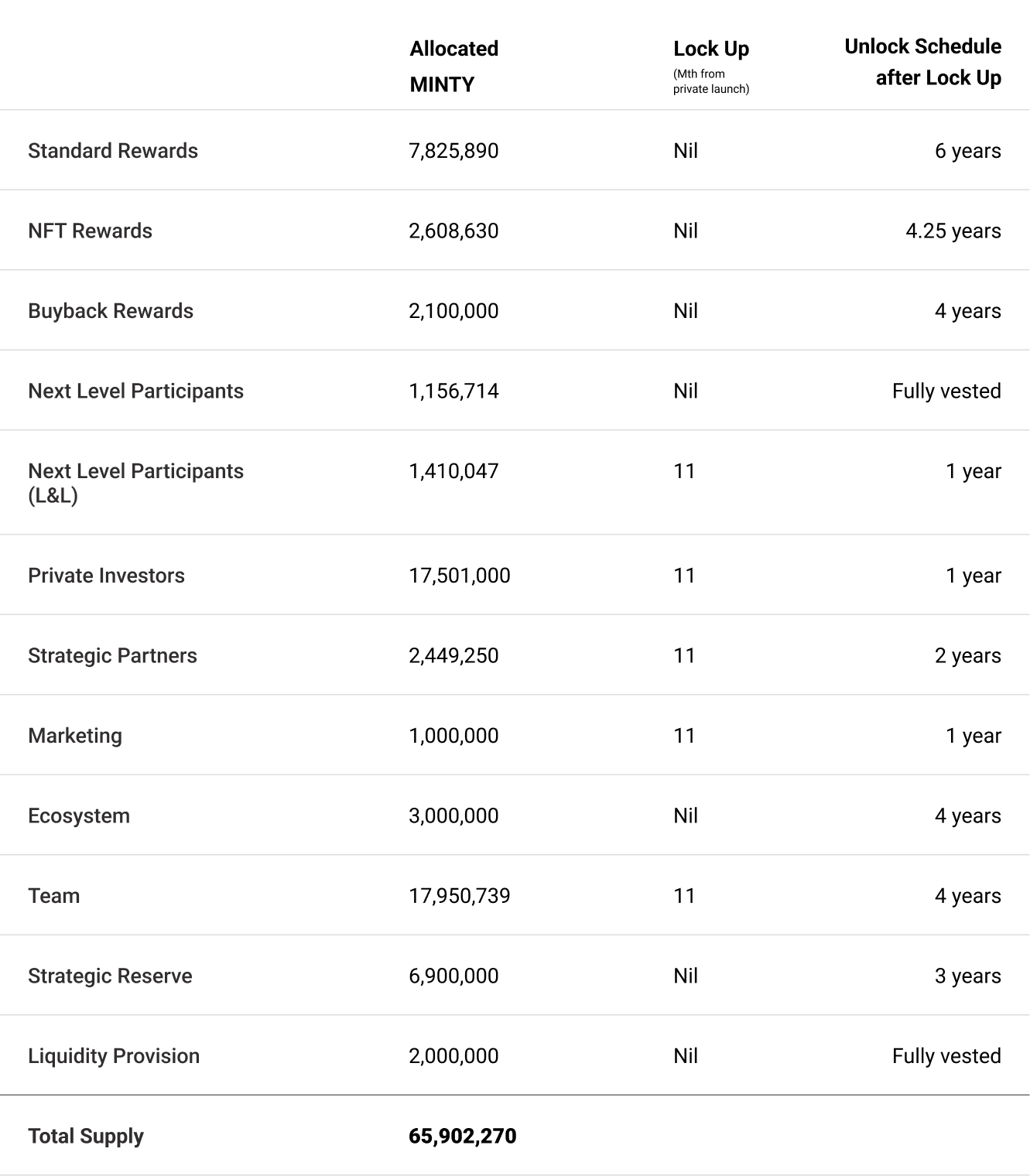

Minterest’s Tokenomics includes a total MINTY token supply of 65,902,270 MINTY which begin emitting block-by-block upon the launch of the protocol during its Private Launch. The unlocking process is smooth, with no sudden tranches of tokens being released. The Minterest protocol’s tokenomics structure has been designed to align incentives across all stakeholders, with the longevity of the Minterest protocol being top of mind.

Emission Rewards

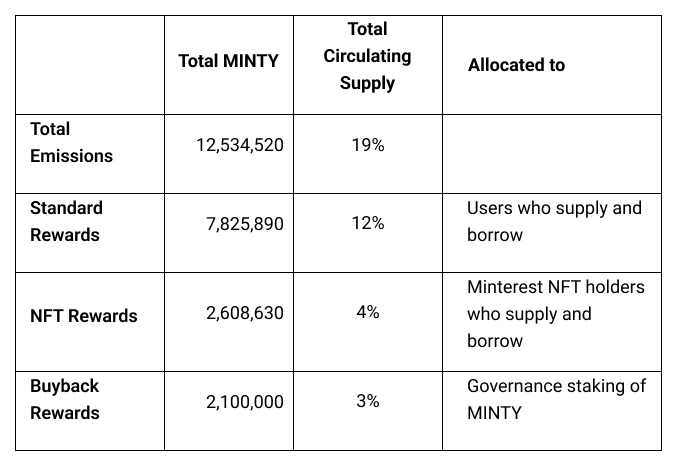

100% of Minterest token emissions are rewards issued to users in return for their contributing value to the protocol. The distribution of all emission rewards is subject to a mathematical logic which unlocks every MINTY token over a 12-month period from when it was earned by the user. Doing so provides users with the experience of a smooth unlocking schedule while resolving the technical and financial improbability of tracking every MINTY token state on chain.

Standard Rewards

Standard Rewards are earned by suppliers and borrowers of liquidity. The number of Standard Rewards each supplier and borrower receives is relative to their proportion of either pool in each market they participate in. The proportion of total Standard Rewards earned by each market, as well as for suppliers and borrowers within the market, is set independently from others, enabling optimisation of protocol outcomes.

NFT Rewards

Minterest NFTs, detailed above, allow holders to receive NFT Rewards in proportion to their Standard Rewards as determined by the NFT tier. MINTY equivalent to 50% of Standard Rewards is allocated as total NFT Rewards, ensuring NFT Rewards cannot reduce Standard Rewards for any user.

Buyback Rewards

Buyback Rewards subsidise Governance Rewards during the protocol’s launch phases. They do so to incentivise users to stake MINTY and participate in governance when the user ecosystem and TVL are still developing, and buyback value is likely sub-optimal in acting as an incentive.

Next Level Participants

2,566,761 MINTY tokens designed for early supporters. These tokens unlock immediately during the Private Launch for participants of the Minterest LBP.

Private Investors

Early supporters will receive 17,501,000 MINTY tokens unlocked block-by-block over 1 year, with a cliff of 11 months. The Minterest protocol is structured to allow early supporters to easily auto-stake tokens unlocking from the contract into the protocol’s governance processes to immediately generate substantial APY from the Buyback process from the Private Launch.

Strategic Partners

2,449,250 MINTY tokens are allocated to advisors & strategic partners, with a cliff of 11 months, and unlocked block-by-block over 2 years.

Marketing

1,000,000 MINTY tokens are allocated for marketing-related activities with a cliff of 11 months, and unlocked block-by-block over 1 year.

Ecosystem

3,000,000 MINTY tokens are allocated for continued growth of the Minterest protocol across a series of possible uses such as grants or partnership development with a cliff of 11 months, and unlock block-by-block over 4 years.

Team

17,950,739 MINTY tokens are allocated to the team developing the Minterest protocol, and unlock block-by-block over 4 years after 11 months of cliff.

Strategic Reserve

6,900,000 MINTY tokens are allocated to support Minterest’s token economy through the accumulation and retention of MINTY, from either NFT, Buyback or Governance Rewards. Doing so develops scarcity by reducing on market supply of MINTY.

The Strategic Reserve receives surplus NFT and Buyback Rewards, with a significant portion of MINTY assigned to support those reward systems anticipated to be surplus to requirements. A proportion of the Strategic Reserve is also continually staked to accumulate Governance Rewards, which compound long term but does not participate in governance proposals.

This results in the Strategic Reserve losing accumulated loyalty rewards every 6 months, preventing it from disproportionately accumulating Governance Rewards at the cost of protocol users.

Liquidity Provision

2,000,000 MINTY tokens are allocated to liquidity provision without any cliff, fully unlocked. These tokens allow borrowers to access loans, increasing the amount of money available.

Last updated