Overview

The Minterest protocol is decentralised non-custodial lending and borrowing protocol. Users can participate as suppliers and borrowers of liquidity, as well as stakers of MINTY token. Suppliers provide liquidity to a market and can earn interest on the crypto assets provided. Borrowers are able to borrow liquidity using overcollateralized loans or flash loans with no collateral. Stakers can stake MINTY tokens to earn governance rewards for participating in the protocol's governance.

Architecture overview

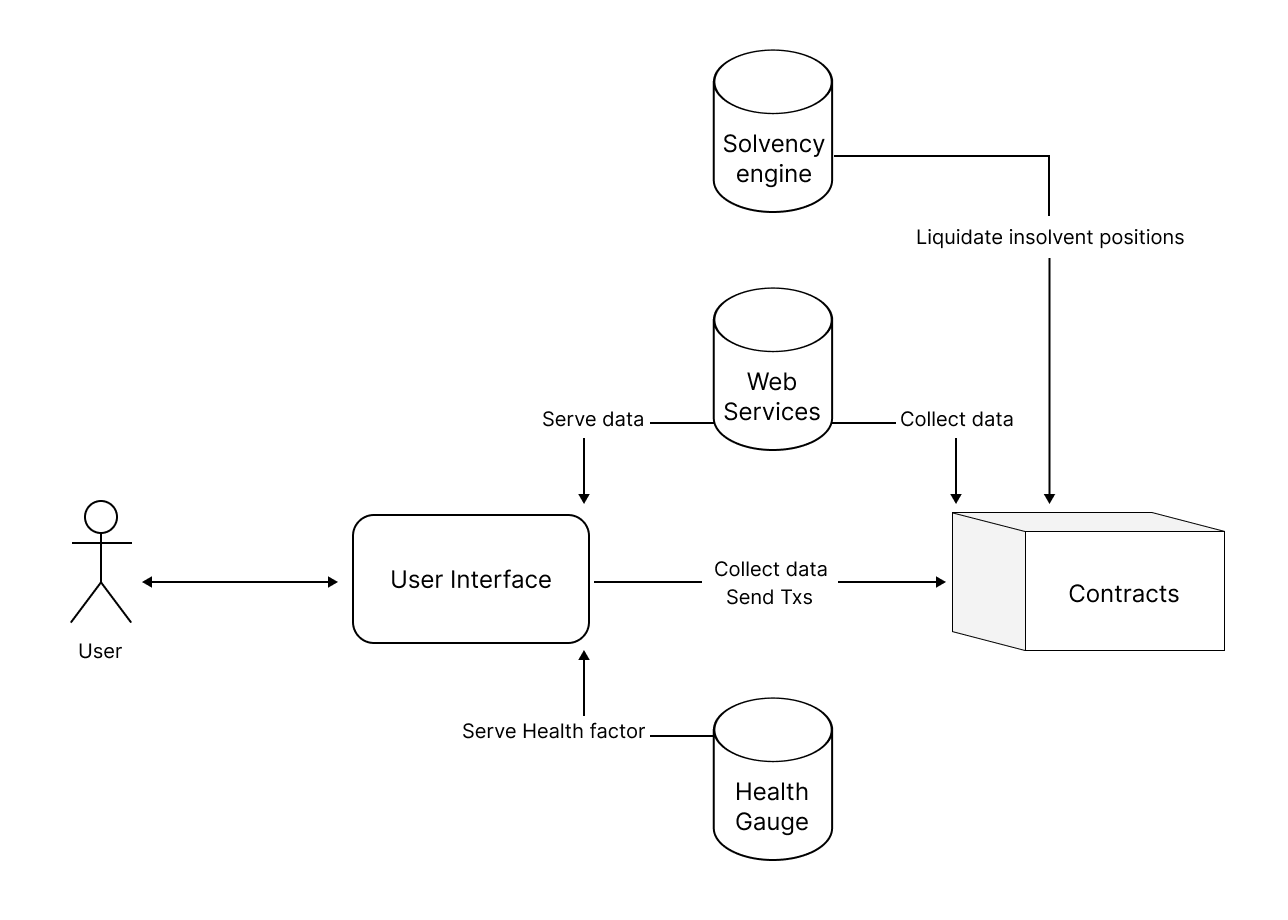

Minterest protocol comprises Solidity contracts on Ethereum main net, Liquidation engine, Risk engine and publicly available User Interface (UI) supported by web services to provide user data in a timely manner.

The Solidity contracts executed and stored in Ethereum main net, are holding the core logic of the protocol - liquidity pools, economy models of liquidity markets, interest accrual logic, NFT contract, governance logic and many more.

The UI and supporting web services provide a user friendly access to the contracts. The UI also collects statistics and historic data for every user and provides it in a form of charts.

The Liquidation engine* is a set of services that track solvency of the protocol users and liquidate the insolvent positions if deemed profitable to cover expenses.

More detailed technical information can be found in the Technical paper. *Note that Minterest’s Autoliquidation Engine has been renamed to Solvency Engine

Last updated